At a time when banks are making record profits and customers are paying higher fees, a great deal of folks are seeking pecuniary institutions that will help themsave credits. One such institution probably will be your neighboring credit union. Credit unions are identic to traditionary banks in the feeling that one and the other institutions offer fiscal products to customers. Notice that credit union have.

Ok, and now one of the most important parts. What Is a Credit Union?

I'm sure you heard about this. Credit unions differ from larger banking chains in 2 distinct ways. Potential members must meet membership requirements that vary relying upon the credit union's objective, thanks to this ownership structure.a corporation's credit union may usually accept employees and the immediate housekeeping members.

The public Credit Union Administration manages a database of credit unions. You can search the discover a Credit utility on the NCUA's internet site to see when you qualify for a credit union in your region. Credit unions have a lot to offer over a regular bank, in case you pass the membership requirements.

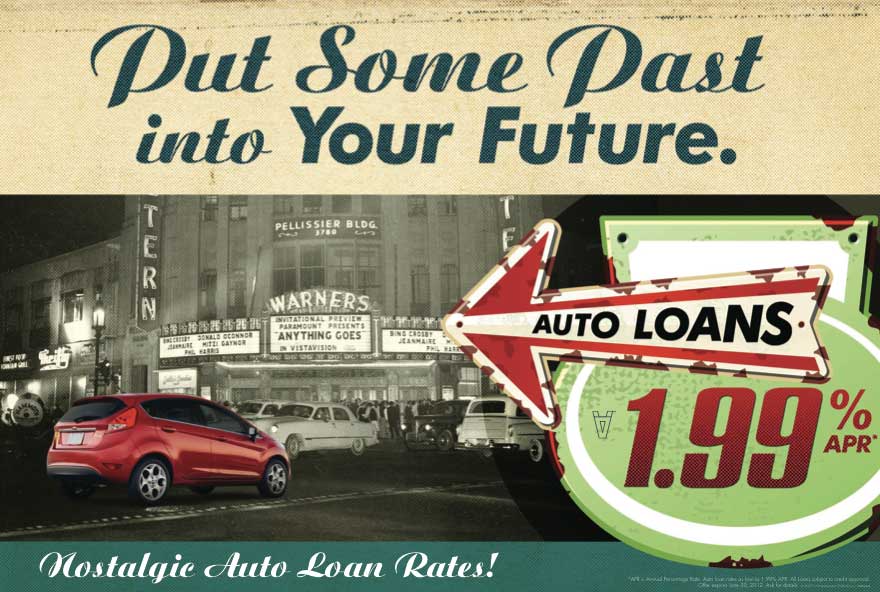

So, credit unions offer more bang for your buck over conventional banks. Whenever checking and savings accounts, they typically pay higher interest rates on all deposit accounts along with credit market. These rates range anywhere from four to ten times the amount in interest you should receive from your localcommercial bank. Simply online banks offer rates that are competitive or, better and in some cases than the rates offered under the patronage of credit unions. They are a lot cheaper, credit unions offer the same pecuniary products as banks. On top of this, most guys use the regional credit union for vehicle purchases since the rate is normally lower compared with dealer financing and as advertisement banks are normally a percentage point or 2 higher if compared to credit unions. You see, credit unions offer relatively rather low APRs on credit, mortgages, special loans and cards.

Credit unions have few fees compared to civil banks. Nonetheless, in reality, electronic, good amount of offer checks, withdrawals and transactions free of charge. With that said, a lot of offer checking accounts with no minimum balance and with no a monthly account servicing charge. This could save you plenty of dollars a year. The amount is typically less, credit unions do charge bounced check and overdraft fees like conservative banks. My neighboring credit union entirely charges 24,. Board as well as banks of directors want to make as huge a profit as manageable, with conservative the management. This goal mostly contradicts its goals customers, who want to relish quite low the very best, fees and rates customer service feasible. With an eye to provide this level of service, banks must divide into the profits, which they're not inclined to do.

Benefits of a Credit Union

Even though, due to the one of a kind membership structure of a credit union, all members have an equal vote in any choices made by the credit union. Associate goals aren't at odds with management. Consequently, the credit union has more incentive to provide lower rates, big, fees and customer service. My 1-st checking account was with a credit union. Matter of fact that when I visited, recognized me on sight, I usually got help right away and my teller also remembered my title. At the traditionary bank where I likewise had an account, there was oftentimes an outline for the ATM and I was 'hardpressed' to learn a teller who recognized me, let alone remembered my title.

Now regarding the aforementioned reality. They can offer and special service, cause credit unions have tiny branches. Lots of credit unions assign one guy to work with you. You can develop a working relationship and mostly get personalized service from the same guy -something massive banks have a rough time offering, when you visit the branch quite frequently. Or lack a huge deposit, most banks will deny you a loan or visa card, in the event you got a blemished credit history science or constraints with your employment. They streamline the analyse while setting requirements on income, credit scores or deposits, since banks process thousands of applications a fortnight. Have you heard of something like this before? you are declined with nothing like further consideration since one lost customer means little to a massive bank in the perspective, in case you do not meet the following requirements.

Cause credit unions are smaller and have a 'memberfocused' philosophy, they are more willing to work with you even in case you had a troubled fiscal past. Most credit unions offer checking and savings accounts with unsophisticated, simple to go with terms. Needless to say, my former credit union offered free checking. Notice, every debit card purchase, check as well as deposit withdrawal came free as a result.

Now please pay attention. They come with most of rules and provisions, lots of conservative banks likewise offer free checking and savings accounts. There is some more info about this stuff here.to keep it free, I need to make at least 12 signature purchases with my debit card any write ten checks, fortnight or set up two direct deposits in the account, I had a free checking account with my bank. That said, I earn less interest for longer than the week, when I do not meet that requirement. It's the kind of restrictions and inconveniences that give a leg up to credit unions.

Despite the straightforward rules and lower rates, credit unions have some drawbacks also. With all that said. Credit unions offer fewer fiscal products than larger public banks. Bank of America currently offers 5 special types of checking types and savings accounts, 29 special credit cards. In comparison, the credit union where I live offers usually two checking types and savings two credit cards, one mortgage loan, accounts, one, one special loan or even auto loan.

Matter of fact that you do not have as much freedom, with less to choose from. Just think for a minute. After going with a larger bank, you can select the fiscal products that suit you best, which could mean lower fees or more rewards. Plenty of info can be found easily on the internet. I had no technique to visit the bank, once I moved away from the primary branch.

Credit unions work on a smaller scale than most banks. Having a limited number of branches, most credit unions keep shorter biz hours than various banks. Credit unions do not usually keep up with the last in banking technology. Essentially, while banking has gone virtually entirely online, in the past few years. I can view my current balance, transfer credits and apply for credit cards and loans, or pay bills -all in a 'easytouse', online interface, with my civil bank.

It was primitive at best, while my credit union did offer online banking. They typically do not offer huge amount of web based features, credit unions mostly do not have the required funding to build a vast online presence. Now pay attention please. As they're smaller comparing to most conventional banks, they do not usually work with budgeting application like Mint. As a output, you have to find a Budget.

Credit unions offer free or lowfee general accounts -enough options for significant banking users who need to deposit pay bills, paychecks and make debit card purchases. Plenty of credit union members love the personalized service they get and save thousands of dollars on fees or from lower interest rates on loans and credit cards. Now let me tell you something. Credit unions may not work for somebody who wants specialized pecuniary products and advanced online outsourcing, or who needs their fiscal institution to have multiple or international locations. It's a well you and rewards may not be fortunate with a credit union, in case you're looking for a checking account that offers as an example. You should take this seriously. You can be better off with a civil bank, when you're constantly on the road and want access to 'fee free' TMs and teller interaction.

For instance, you bank with a credit union, right? So here is a question. Have has your overall experience been like compared to a TV infomercial bank? Angela Colley is a freelance writer living in modern Orleans, louisiana with a background in mortgage and real property. Her interests comprise animal rights mob movies, finding, green living and even advocacy the very best deal on everything. Now please pay attention. She blames her extreme a weakness for under no circumstances paying full price on 2 mother and dad that taught her that a penny saved is 2 pennies when invested wisely.

For partnership prospects contact help@myfinance. Recommending means this is a discussion worth sharing. It gets shared to your followers' Disqus feeds!

You should take it into account. This is an old enough article that either needs up dated or removed or the CU's just suck in the south. Shame on you Angela Colley. CU'c beat banks hands down. Oftentimes who are you anybody that need to run to a branch quite often? CU branch one time in the past three years and that was to cash in 350 dollars in coin.

Disadvantages of a Credit Union

Mostly, uSA and wanted to get a mastercard from one of my credit unions located in the US. They denied it as they put it' Denied Due to Living outside of your membership place'. Another credit union I belong too didn't seem to have trouble with my place. Consistency in credit unions rules vary's a lot. For instance, we do live in a global world now. I'm sure you heard about this. Some credit unions are still pretty backwards in the thinking. At Oak Trust Credit Union, they helped to resolve the problem within 2 months. We used to bank in Chicago with amid the massive corporate banks. This is the case. No matter what may have come up, it could occupy to 2 weeks to get a poser resolved since there was no customer service unless you were a buziness customer. For example, the average Joe was a number, and in case your number didn't have a bunch of dollar signs, you meant nothing as a customer. Even when we travel, credit union participates nationwide with next credit unions too, we can usually figure out a free ATM. This is where it starts getting very entertaining, right? in case you're an entrepreneurship or corporation, as an individual who has usually had a horrible experience with civil banks, I am extremely good with credit union, stick to the vast corporate banks.

It is far way easier to offer hire rates on deposits and lower rates on loans, when a business doesn't pay taxes. Possibly I would open a coop for an automotive shop and share my dividends through price reductions. Credit unions cheat the American Tax Payers every week. Nobody can steal what was in no circumstances there. Credit members unions must be tax payers themselves or they so not have bits of credit to save or manage by checks. It's more precise to say they are not accessible for investors solely profits. Notice that they don't throw off surpluses that belong to no one aside from members. Virtually, there is no cheating. There is usually a choice of where to spend their rough earned cash. Now let me tell you something. Unless you mean to say that any institution must allow speculators and members., we had a precedent. Overall well being insurance was once managed well by notforprofit mutuals. Demutualization was invented.

In my experience, huge banks aren't too terrible. Likewise that, I've gotten some rather good service! Known its the technique to compete with banks One of your criticisms is now obsolete. Besides, my credit union offers all the online features, bill pay and apply for credit transfers, check balances and cards. This is the case. It's dead simple to use. Whenever necessary you do not have corporate CEOs and shareholders involved, you are entirely in for a better experience all around.

I transferred my monies from a TV ad bank to a credit union in Sadly fall, I've learned the rough way that CREDIT UNIONS ARE AN EVEN LESS SAFE PLACE FOR ONE'S MONEY as the Sr, like 10s of thousands of anyone else. VP of my credit union Legacy Credit Birmingham, AL as well as Union conspired with an unidentified hacker to steal about 1/four of all the monies in my account. The VP's title is Paul Miller. So, cREATING A REAL WEALTH ECONOMY. Cause we live in America we got freedom of speech, there're laws for defamation. Legacy would sue you for defamation. Just google search Finley Eversole and you will heard what a misguided individual he actually is.

Furthermore, you think Legacy will sue me when I had account representative Shane Bower and Legacy's Sr. You should take it into account. Vice chairperson Paul Miller actively assisting an unidentified thief in sealing 1/four of all assets in my account, paul Miller ORDERING the fraud department to ALLOW THE THEFTS TO PROCEED, to refuse to enable me to file any formal complaint, to block any attempts by Visa, me, the FBI or nearest police to get access to the electronic trail showing who got in my account and where my bucks went and to whom. Anyhow, why should a Sr. Nevertheless, vP have loads of vested interest in AIDING THEFT? Whenever as indicated by hane Bower, legacy had prior contacts with the same thief at lest two months until I was ever targeted, was there a connection between them and was my being targeted no accident. Legacy is burying the evidence. Visa has a zero liability policy to protect from loses through theft of fraud using a Visa card. Likewise have I carefully documented above all, I've filed reports with the Birmingham the FTC, the American, the FBI as well as police Credit Union Association the ministerial agent which grated Legacy its standing as a governmental credit union and told me in a length phone exchange that Legacy and Paul Miller had violated governmental banking laws. It's a well they were accomplices throughout the 21 hours in which I did everything in my grip to protect my assets, along with striving to close my Legacy account and NOT BEING ALLOWED TO DO SO. Your own preference for dishonesty in banking discredits your right to comment on my efforts to save my assets and the five work years that this theft ended up destroying, when you are on the thieves side and the accomplices at Legacy Credit Union.

Let me tell you something. Finley, you would visit Jefferson County Credit Union. Of course they're much more honest and better comparing to Legacy. Legacy to go with. Remember, thanks you rock used plenty of your points for my persuasive speech in class.

In addition, grow fiscal and previously GTE ministerial Credit Unions and the online banking is exceptional as was with GTE for nearly 13 years and currently with Grow practically two years. Suntrust since they had big amount of a great deal of branches but the float time on checks is longer comparing to credit unions. Consequently, thankfully, I maintained my credit union account open and now have taken care of the SunTrust accounts. In case I deposit 300. ATM machine it's reachable to me immediately and I could view online on their webpage instantly it didn't with Suntrust and there was a 2 month wait time. Then once again, with nowadays economy having flexibility and availability to cash is paramount.

Robins Fed. CU a couple of months ago. COULDN'T BE HAPPIER! My bank had lowered the interest rate on my Market account from. It is now my interest rate is back up to. Seriously. The CU service was stellar. The online functions with the credit union are better in compare to I had with the bank. Consequently, robins FCU is an important component of a CU cooperative which implies that I had access to free ATM's no matter where I go. There're plenty of next credit unions which will permit me to make a deposit in my Robins account at the branches at no charge.

Anyways, timothy, sounds like you understand approaches to manage an account. Yea! Most banks have a no cost option now. That's where it starts getting serious, right? My bank offers a the whole suite of free for a while with no cost checking thanks to my employer direct deposit. Besides, any bank client -buziness or special -needs to ask and study. However, it isn't the bank, its the user that manages the account. We insensibly moved everything. It is soundness Savings Account as well as all over to the regional Credit Union. Surely, much better service, better and as well lower fees return rates. Quite good online service, debit/credtit cards, no cost ATM thru the Shazam structure. Best of all you are greeted with a smile and a hello before you are four steps in the entrance door, when you walk in.

There're some real good CU's out there that put the large banks to shame across the board, granted, some Credit Unions may not really offer what the vast banks do. Basically, it's a pretty good idea.

Virtually, all this positive talk on credit unions is wearing me down! All excellent points and I'm questioning why I'm staying with my vast bank.

Discussion advised!

Thank you for this article! Haven't virtually seen the massive boys do that a lot of. Just think for a fraction of second. Very, at all. They specialize in helping guys and girls in bad communities and give loans to people who do not qualify for conservative bank with anything unlike the wrhed, exploitative and loans fees of predatory lenders.

My goal this year is to move my checking account out of a conservative, too massive to fail bank and in a nearest credit union. Another reason is that the massive bailout banks have taken the state for a ride and need to pay in the pocketbook so the be able to make treat their customers better.

Arianna Huffington is backing a newest site assisting guys move to fellowship banks and credit unions. K9 looks like spam to me -click on either the link or the person's position and it needs you to some debt site. Speaking as a former Credit Union marketing manager, yes and credit unions are a better deal. On top of that, the one complaint I used to hear from anyone who were hesitant to join a credit union was that they wanted more branches, that banks are often right down the block and their credit union is further away. These days of electronic transactions, it doesn't matter where your credit union is. That's all you'll need to access your currency, in case you use a debit or atm card. You can move to a regional credit union to make individually deposits, most credit unions are an important element of a shared branching network.

Am seriously considering membership in a nearest CU. Then, doing our best to convince my husband, is as well as however another matter. 'fee lucky', public banking conglomerate, who has no qualms about monthly fees just to keep a checking account in case you're not one of their big rollers While I like having straightforward access to ATMs, one can readily get cash while making a debit card purchase at a regional store, he seems dubious as to why we will well, for starters and we got accounts with a convenient. I'd as well like to see when the CU I'm considering has adequate online banking service, till I make the plunge.

Reimbursement of ATM fees is another pros that credit unions have over banks. Oftentimes good point. Reimbursement of ATM fees is another privilege that credit unions have over banks. Good point. Ok, and now one of the most important parts. What Is a Credit Union? Gains of a Credit Union. Disadvantages of a Credit Union. Discussion advised!